Did you know your bank might use VantageScore to pre-approve you for a card, while your mortgage lender will almost certainly use a specific FICO score? While both scoring models agree that credit utilization is critically important, they judge your balances by slightly different rules.

Understanding this difference is the key to fine-tuning your credit strategy. This guide will break down how FICO and VantageScore weigh your credit utilization, reveal which one is harsher on high balances, and give you a clear plan to maximize your score under either model.

FICO Score’s Rules on Utilization

FICO’s models have been the industry standard for decades, with a sharp focus on predicting credit risk. Its approach to utilization is nuanced and two-fold.

- The Two Factors FICO Considers:

- Overall Utilization: This is your total balance across all cards divided by your total credit limits.

- Per-Card Utilization: FICO also scrutinizes the utilization on each individual card. The model is known to heavily penalize any single card that has a utilization rate over 50%, even if your overall utilization is low.

- The 30% and 10% Rules for FICO: For FICO scores, the 30% threshold is a well-known danger zone. Going above it can cause a significant score drop. However, the true “excellent” range is below 10%. The All Zero Except One (AZEO) strategy—where all cards report a $0 balance except one that reports 1-9%—is specifically designed to maximize FICO scores.

- FICO’s Sensitivity: FICO scores are highly sensitive to month-to-month changes in reported utilization. One month of high reporting can cause a temporary but sharp drop, which quickly recovers once a low balance is reported again.

VantageScore’s Rules on Utilization

VantageScore, created by the three credit bureaus, is a newer model that often takes a more simplified and aggressive stance on certain factors, especially utilization.

- VantageScore’s Priorities: VantageScore 3.0 and 4.0 models place an “extremely influential” emphasis on your total credit usage and available credit. It tends to focus more holistically on your overall debt picture.

- VantageScore’s Penalty: VantageScore can be harsher on consistently high overall utilization than FICO. It is particularly sensitive to your total credit balance getting too close to your total limits. The model explicitly calls out high utilization as a major negative factor.

- The 30% and 10% Rules for VantageScore: While the same general guidelines apply, VantageScore may begin to lower your score more aggressively than FICO as you approach the 30% mark, especially if you have a limited credit history.

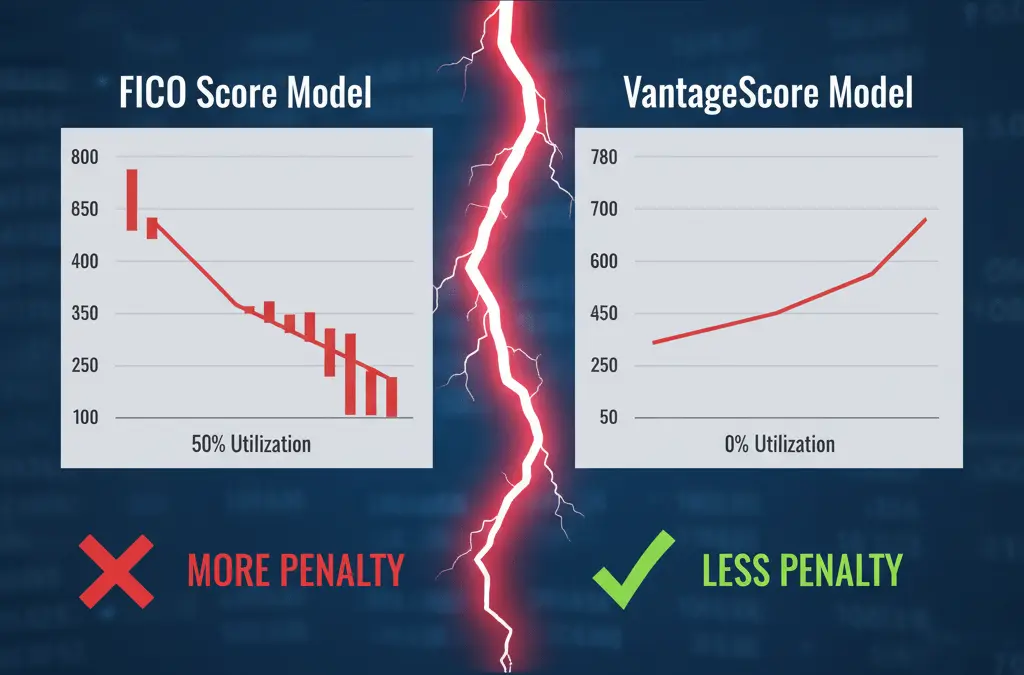

⚔️ Head-to-Head: Which Model Penalizes More?

Let’s break down the key differences in a direct comparison.

| Factor | FICO Score (e.g., FICO 8) | VantageScore (e.g., VantageScore 3.0/4.0) |

|---|---|---|

| Top Consideration | Per-Card Utilization & Overall Utilization | Total Credit Usage & Balances |

| Breaching 30% | Significant score drop, but impact can be lessened if other cards are at 0%. | Potentially a more consistent and severe penalty due to its focus on total balances. |

| Extreme Utilization (e.g., 70%) | Very severe penalty. Can drop a 740+ score by 100+ points. | Extremely severe penalty. Often ranks utilization as a top influencing factor. |

| Ideal Target | ~1% (AZEO Strategy) | 1% – 5% overall utilization. |

The Verdict: While both are strict, VantageScore often takes a harder line against high overall utilization. Its scoring explanations frequently highlight “total credit usage” as a primary reason for a score being what it is. However, FICO’s sensitivity to individual card utilization means you can’t let any single card’s balance get too high.

How to Adapt Your Strategy for Maximum Scores

Your action plan should change depending on which score you’re trying to optimize.

If Your Lender Uses FICO (Most Common):

- Your Strategy: Implement the AZEO (All Zero Except One) strategy.

- The Reason: Since FICO heavily weights per-card utilization, you want to show most cards with a $0 balance. Letting one card report a small, non-zero balance (1-9%) proves you’re actively using credit responsibly without triggering high-utilization penalties on multiple cards.

If Your Lender Uses VantageScore (Common for Credit Monitoring Apps):

- Your Strategy: Focus intensely on keeping your total overall utilization below 10%.

- The Reason: VantageScore cares most about your aggregate debt. You have more flexibility on a per-card basis, as long as the sum of all your balances remains very low relative to your total limits.

The Universal Truth for Both Models:

No matter which model your lender uses, one rule remains absolute: For a top-tier score, you must keep your total credit utilization below 10%. Aiming for 1% is the gold standard that satisfies both models perfectly.

Conclusion and Your Next Step

In the battle of FICO vs. VantageScore, both models demand low credit utilization, but VantageScore can be more consistently punitive for high overall balances.

Final Advice: Since the vast majority of major lenders (especially for mortgages, auto loans, and top credit cards) use FICO scores, you should prioritize optimizing for the FICO model using the AZEO strategy. This will naturally keep your overall utilization low, which also keeps your VantageScore in excellent shape.