You finally did it. You saved up, negotiated, and paid off that old collections account that’s been haunting your credit report for months. You wait for your score to update, expecting a significant jump… only to see a minor bump, or worse, no change at all. Your credit utilization ratio—the amount of credit you’re using—looks exactly the same.

It’s a frustrating and confusing moment. If you paid off a debt, why didn’t it fix the part of your score that’s all about debt?

This experience stems from a fundamental misunderstanding of how your credit score is built. People often see “debt” as one big category, but your FICO score sees it in two very separate, distinct buckets. Paying off collections is a critical step, but it fixes a different problem than the one causing high utilization.

The Myth: Collections and Utilization Are the Same Problem

It’s easy to see why this myth persists. Both involve owing money, and both can drag your score down.

- The Logic: “I had debt in collections, and I have debt on my credit cards. Paying off debt should improve my score across the board, right?”

- The Reality of Paying Collections: The primary impact of paying a collections account is on the status of that specific account. It changes from “Unpaid” to “Paid.” This is a good thing and can help, especially with newer FICO models that weigh paid collections less heavily. However, it does not directly inject new, positive data into the part of the score that calculates your credit card usage.

The Reality: The Two Pillars of Your FICO Score

Think of your credit score as a house supported by five main pillars. Two of the biggest pillars are right next to each other, but they are made of completely different materials. Fixing one doesn’t repair the other.

Pillar 1: Amounts Owed (Your Credit Utilization)

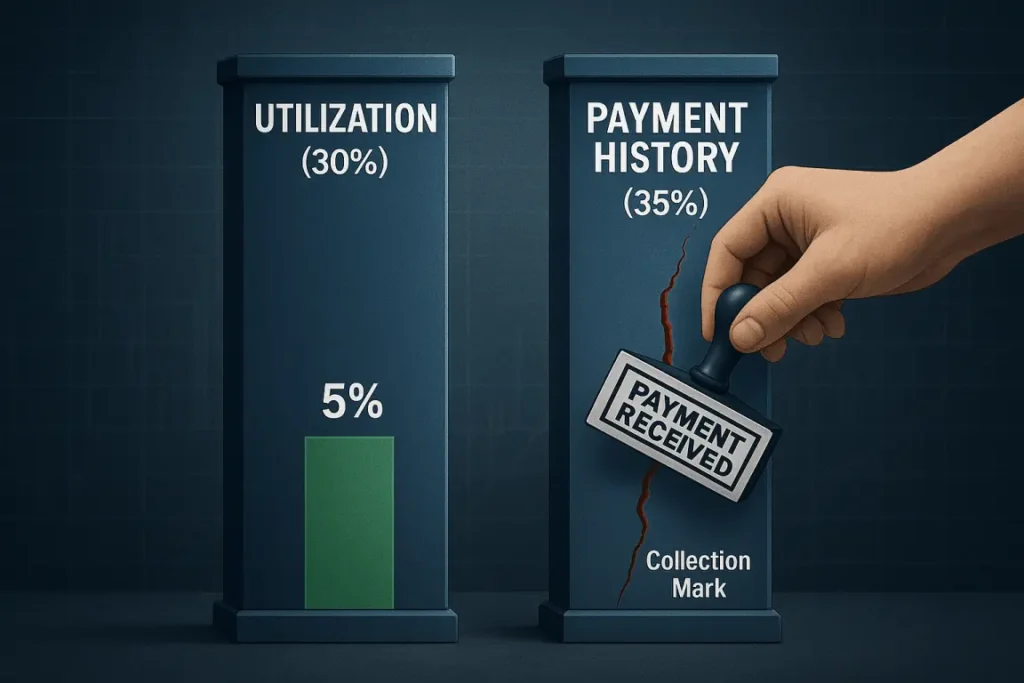

- Weight: 30% of your FICO Score

- What It Is: This is a snapshot of your current revolving debt (credit cards and lines of credit). It’s a simple ratio:Total Credit Card Balances ÷ Total Credit Card Limits = Your Utilization

- Its Focus: Open and active accounts. It asks, “Right now, how much of their available credit is this person using?”

Pillar 2: Payment History (Your Collections)

- Weight: 35% of your FICO Score (The single most important factor)

- What It Is: This is a history of how you’ve managed all your credit accounts over time. A collections account is a severe negative mark in this category because it indicates a failure to repay a debt as agreed.

- Its Focus: Past behavior. It asks, “Has this person reliably made their payments in the past?”

When you pay a collections account, you are adding a footnote to the Payment History pillar that says “Paid.” This is better than “Unpaid,” but the history of the missed payment that led to the collection still remains. You are not altering the Amounts Owed pillar at all, because a collections account is not considered an “active” revolving account for utilization calculations.

Your Action Plan: Fight the Two Battles Separately

To truly rebuild your score, you need a two-front war strategy.

Battle #1: Repair Your Payment History (The 35% Pillar)

- Pay or Settle Collections: As you’ve done, get collections accounts to a “Paid” status. For the newest FICO scores (9 and 10), this can significantly reduce their negative impact.

- Focus on On-Time Payments: The absolute best thing you can do for this pillar is to make every single payment on every single account on time, from now on. Time and consistent good behavior are the best healers for a damaged payment history.

Battle #2: Optimize Your Amounts Owed (The 30% Pillar)

- Lower Your Credit Card Balances: This is the only way to fix a high utilization ratio. Focus on paying down the balances on your open, active credit cards.

- Aim for the 10% Sweet Spot: To maximize your score, get your total reported balances below 10% of your total credit limits. This often means making payments before your statement closing date.

- Keep Accounts Open: Don’t close old cards, as that shrinks your total available credit and can instantly increase your utilization.

Paying off collections is like putting a bandage on a deep wound—it’s a necessary first step, but the underlying bone (your payment history) is still broken. Paying down your credit card balances is like doing physical therapy for a different, sore muscle (your utilization). You need to do both to get your entire financial body healthy again.