Want to boost your FICO score by 20-40 points almost overnight? There’s a powerful credit optimization strategy that most people don’t know about, yet it consistently delivers dramatic results for those who implement it correctly. Welcome to AZEO – the secret weapon of credit experts.

What is AZEO and Why Does It Work So Well?

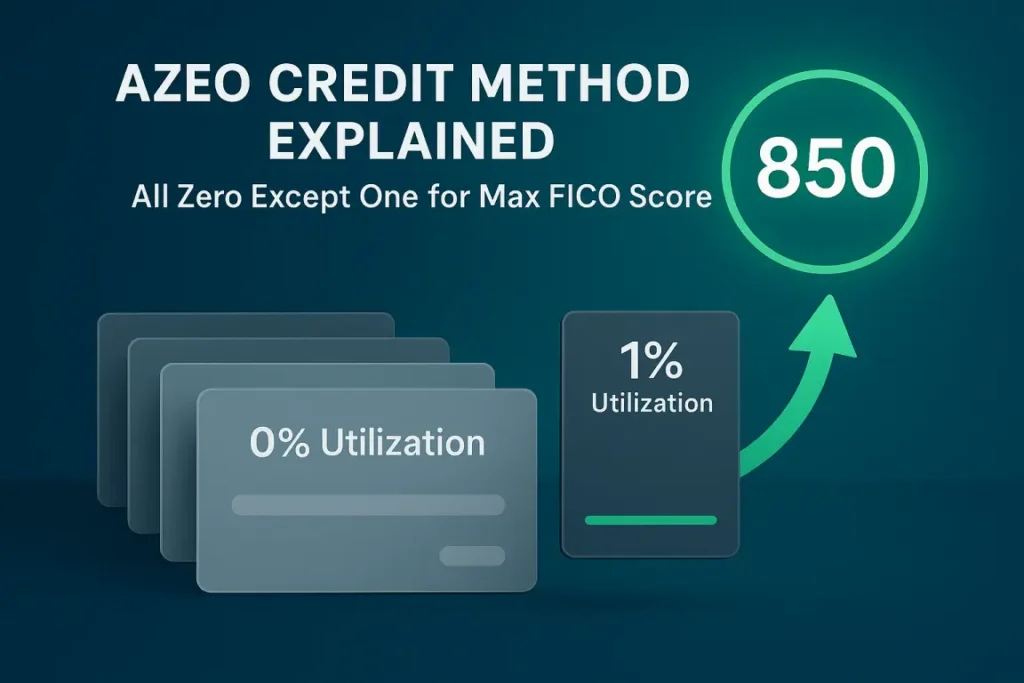

AZEO stands for “All Zero Except One” – a strategic approach to credit card balance management where you allow only one card to report a small balance while ensuring all other cards report a $0 balance.

The Psychology Behind FICO’s Preference

Why would having a small balance be better than having all zeros? The answer lies in what the FICO scoring algorithm is trying to measure:

- Proof of Responsible Usage: When all cards show $0 balances, FICO has no recent data about how you manage revolving credit. It’s like having a driver’s license but never driving – the system can’t assess your skills.

- The Sweet Spot: A tiny balance (1-9%) demonstrates you’re actively using credit while maintaining exceptional control over your finances.

- The Perfect Signal: AZEO tells FICO: “I use credit regularly, but I’m so responsible that I pay off almost everything while still maintaining active accounts.”

The Mathematical Magic of AZEO

Understanding the FICO Penalty Structure

Most people don’t realize that having all accounts report $0 can actually cost you 10-25 points compared to optimal utilization. FICO’s newer models (8 and 9) specifically penalize what they interpret as “no recent revolving activity.”

The 1% Magic Number

When you implement AZEO correctly:

- Your overall utilization stays in the ideal 1-5% range

- Your individual card utilization on the “one” card stays below 9%

- You avoid the “all zero” penalty while demonstrating perfect credit management

Example Calculation:

- Card A: $4,000 limit, $0 balance

- Card B: $6,000 limit, $0 balance

- Card C: $10,000 limit, $80 balance (0.8% utilization)

- Overall utilization: $80/$20,000 = 0.4% (Excellent!)

🛠️ The 3-Step AZEO Implementation Plan

Step 1: Identify and Zero Out All Cards (The “Zeros”)

Know Your Reporting Dates: This is the most critical step. You must know the statement closing date for every credit card. This is when balances are reported to credit bureaus – typically 3-5 days before your payment due date.

The Pre-Statement Payment Strategy:

- 3-5 days before each card’s statement date, log in and pay the balance down to $0

- The only exception is your designated “one” card

- Set calendar reminders for each card’s statement date

Manage Automatic Payments: During your AZEO period, temporarily move any automatic subscriptions or bills away from your “zero” cards to prevent unexpected charges.

Step 2: Select and Manage Your “One” Card

Choosing the Right Card:

- Highest limit card: Ideal because 1% of a high limit is easier to manage

- Oldest card: Helps with credit age factors

- Card with fastest reporting: Some issuers update bureaus more frequently

Setting the Perfect Balance:

- For a $5,000 limit card: aim for $25-$50 balance (0.5%-1%)

- For a $10,000 limit card: $50-$100 is perfect

- Always stay below 5% on this card

Pro Tip: Make a small purchase a few days before the statement date, then let just that amount report.

Step 3: Timing and Duration

When to Use AZEO:

- 30-60 days before applying for a mortgage, auto loan, or refinancing

- When you need to quickly boost your score for better rates

- During credit repair periods to maximize scoring

When to Stop: Continue AZEO until your loan has completely closed and funded. Don’t stop once you’re approved – stop once the deal is done.

🛡️ Common AZEO Pitfalls and How to Avoid Them

The Major Risks

- Accidental High Balance on “One” Card:

- One unexpected charge can ruin the strategy

- Solution: Set balance alerts and check the card regularly

- Missing a “Zero” Card’s Statement Date:

- Even a small balance on a “zero” card hurts the strategy

- Solution: Calendar reminders for every card’s statement date

- Forgetting About Authorized User Cards:

- These count toward your “all zero” requirement

- Solution: Include all AU cards in your planning

Advanced AZEO Considerations

Multiple Card Strategy: If you have many cards, consider letting 2 cards report tiny balances (still keeping overall utilization below 5%). This provides a safety net if one card accidentally reports high.

VantageScore Impact: While AZEO is optimized for FICO, it generally works well for VantageScore too, though the impact might be less dramatic.

Business Cards: Most business cards don’t report to personal credit, but some do. Know your cards’ reporting policies.

Real-World AZEO Success Story

Mark was stuck at a 724 FICO score while trying to qualify for the best mortgage rates. He needed 740+ for the optimal rate. After researching, he implemented AZEO:

- Before AZEO: Mixed balances across 4 cards, overall utilization 15%

- FICO Score: 724

- After 2 Months of AZEO: All cards at $0 except one with $45 balance (on $8,000 limit)

- New FICO Score: 761

- Result: Qualified for the best available mortgage rate, saving $47,000 over the loan’s life

Is AZEO Right for You?

Perfect Candidates for AZEO:

- People within 30-60 days of major loan applications

- Those with scores in the 680-750 range looking for a boost

- Credit optimizers wanting every possible point

Better Alternatives:

- If you’re more than 3 months from any loan applications, simple low utilization (below 9%) is sufficient

- If you struggle with organization, AZEO might be too complex

- If you have very new credit, focus on building history first

The Psychological Benefits of AZEO

Beyond the score improvement, many users report:

- Reduced financial stress from having a clear system

- Better awareness of spending patterns

- Improved confidence when applying for credit

- Development of disciplined financial habits

Ready to Implement AZEO? Get Your Exact Numbers

The biggest AZEO mistake is guessing your balance targets. A $100 mistake on a $2,000 limit card means 5% utilization instead of 1% – potentially costing you valuable points.

Our specialized calculator removes the guesswork by giving you:

- Exact balance targets for your “one” card

- Payment amounts needed to zero out other cards

- Overall utilization projection before you implement

- Customized strategy based on your specific cards and limits

Remember: AZEO isn’t a long-term lifestyle – it’s a strategic tool for specific financial goals. Used correctly, it can be the difference between good rates and great rates, potentially saving you thousands on major loans.