Most people think building a great credit score in the USA is simple:

✅ Pay bills on time

✅ Don’t max out cards

✅ Keep old accounts open

That’s true… but it’s not the full story.

Because here’s the part most people don’t realize:

👉 Paying your card in full doesn’t always mean your credit report shows $0 balance.

And if your report shows the “wrong” utilization at the wrong time, your FICO score can drop even when you’re doing everything right.

This is exactly where a powerful credit strategy comes in:

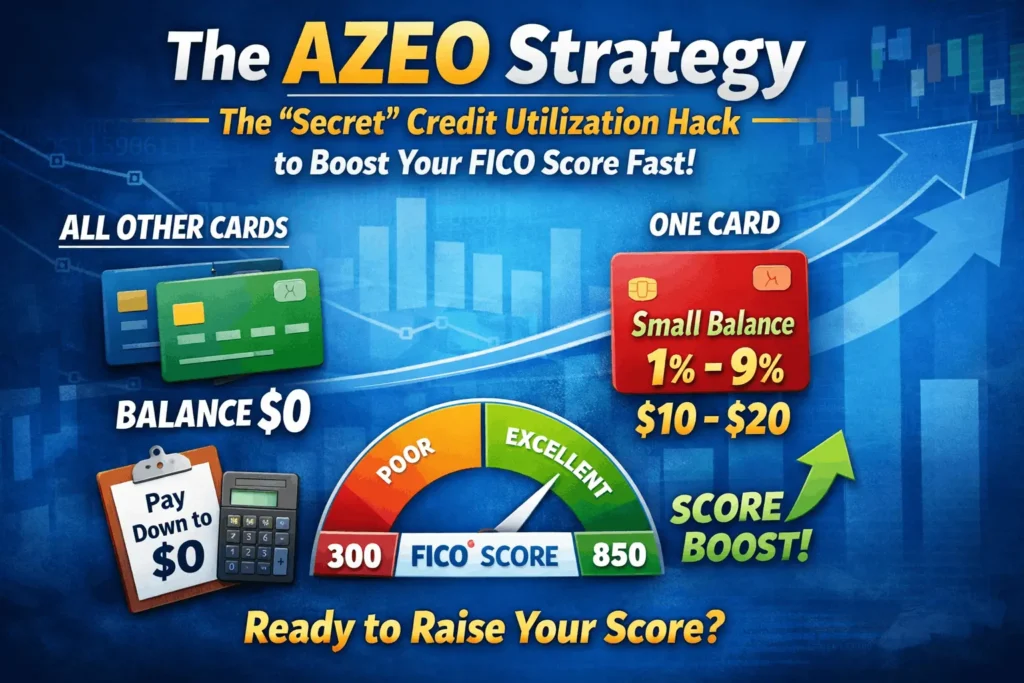

✅AZEO (All Zero Except One)

AZEO is one of the most effective utilization methods used by credit experts and people chasing a 760–850 FICO score.

It’s simple, legal, and works especially well if your credit score feels “stuck.”

Let’s break it down in a clear, step-by-step way.

What exactly is the AZEO Method?

AZEO stands for:

All Zero Except One

Meaning:

- You set all your credit cards to $0 balance

- Except one single credit card

- That one card reports a tiny balance

✅ How much balance should that “One” card have?

The sweet spot is usually:

📌 1% to 9% utilization

Even better: below 3%

Example:

If your credit limit is $1,000, try to report:

- $10 to $30 balance

If your credit limit is $5,000, try:

- $50 to $150 balance

💡 Pro tip: Most experts recommend leaving a small amount like $10–$20 to report.

Why AZEO works (The hidden math behind FICO utilization)

Here’s the part most Discover readers love:

🔥 FICO loves “responsible usage,” not “no usage”

Many people try to be perfect and report:

✅ 0% utilization on all cards

…but your FICO score may not maximize this way.

Because FICO doesn’t just check utilization percentage — it also checks:

- Are you actively using credit?

- Are you managing credit with low risk?

- Is there at least one card showing activity?

✅ 0% utilization vs 1% utilization (Big difference!)

0% utilization often looks like:

➡️ “not using revolving credit”

1% utilization often looks like:

➡️ “using credit responsibly & paying it down”

That small difference can create a score bump, especially for people who already have decent credit.

Step-by-Step Guide to Implement AZEO (The Correct Way)

AZEO is not hard… but the timing is everything.

Most people mess it up because they focus on the Due Date, when the real key is the Statement Closing Date.

Step 1: Find your Statement Closing Dates (NOT the due dates)

Every credit card has two important dates:

- Statement closing date (balance gets reported)

- Payment due date (deadline to avoid interest/late fee)

📌 AZEO works based on the closing date.

You can find your closing date:

- in your card app

- on your PDF statement

- by calling the bank

Step 2: Pay off ALL cards 3 days before the closing date

About 3 days before each statement closing date:

✅ Pay each card down to $0

This ensures they report a zero balance to the credit bureaus.

Step 3: Leave ONE card with a tiny balance ($10–$20)

Pick one card (preferably a major bank card with low utilization).

For that one card:

✅ Leave a small balance like $10–$20 before the statement closes.

So when the statement generates, the card reports a small utilization.

Step 4: Double-check with a Credit Utilization Calculator

Before your statement closes, verify:

- overall utilization

- individual card utilization

Use our free tool:

✅ Credit Utilization Calculator (recommended)

This avoids mistakes like:

- leaving too much balance

- accidentally hitting 10%+

- having 0% on all cards (which reduces AZEO impact)

Who should use AZEO? (Best situations)

AZEO works best when you need a fast credit-score optimization.

✅ 1) People planning to apply for a mortgage

If you’re preparing for:

🏠 Mortgage approval

🏠 Refinance

🏠 FHA / Conventional loans

Then AZEO can help squeeze out extra points before your application.

Even a 10–30 point increase can change:

- interest rate

- eligibility

- approval strength

✅ 2) People applying for a car loan

Auto lenders heavily factor in:

- utilization

- score trend

AZEO can help you look “low risk” on your credit report.

✅ 3) People whose credit score feels “stuck”

This is very common:

You pay on time ✅

You keep balances low ✅

But score doesn’t move ❌

AZEO helps optimize your report to match what FICO prefers.

Important AZEO Tips (avoid common mistakes)

✅ Don’t leave a balance on the wrong card

Avoid leaving a balance on:

- store cards

- cards with very low limits

- cards close to max

✅ Don’t forget: You still must pay in full!

AZEO does NOT mean carrying debt.

After the statement reports:

✅ Pay that small balance off before the due date

So you avoid interest completely.

✅ AZEO is best for “score boosting, not daily life

AZEO is like a score “polish.”

Use it:

- 30–60 days before major loan applications

- when you want maximum score

Not necessary forever.

Conclusion: AZEO works — but consistency matters

AZEO is one of the simplest credit hacks that actually makes sense:

✅ no tricks

✅ no risky moves

✅ just understanding how credit reporting works

If you can control what your statement reports, you can control one of the biggest factors in your FICO score.

💬 What’s your current credit utilization ratio?

(Overall utilization + per-card utilization)

👉 Use our Credit Utilization Calculator and drop your percentage — I can tell you if AZEO would likely boost your score or if a different strategy will work better.