If you’ve ever checked your credit score and been surprised to see it lower than expected, you’ve likely encountered the powerful and often misunderstood influence of your credit utilization ratio. Comprising a substantial 30% of your FICO score, this single metric is the second most important factor in your credit health, right after your payment history.

Yet, for something so critical, a cloud of confusion surrounds it. Many people believe it’s a complex financial concept requiring advanced math. Others make the fatal error of focusing on just one credit card, unaware that the scoring algorithms care about the entire picture.

This comprehensive guide will demystify credit utilization entirely. We will walk you through not just the simple calculations, but the strategic thinking required to transform this number from a score-killer into your most powerful tool for building exceptional credit. By the end, you will know exactly how to calculate, analyze, and optimize your utilization to unlock your financial potential.

Understanding the Core Concept: What is Credit Utilization?

At its heart, credit utilization is a simple measure of risk. It answers a fundamental question for lenders: “How much of the credit available to you are you currently using?”

Think of it this way: if a friend who earns $100,000 a year asks to borrow $500, you’d likely feel comfortable. If the same friend asks to borrow $95,000, the risk feels exponentially higher, even with the same income. Credit utilization works on the same principle. Lenders see someone using a high percentage of their available credit as being financially stretched and, therefore, a higher risk for default.

This is why the FICO scoring model penalizes high utilization so severely. It’s a direct red flag.

The Two Types of Utilization You MUST Monitor

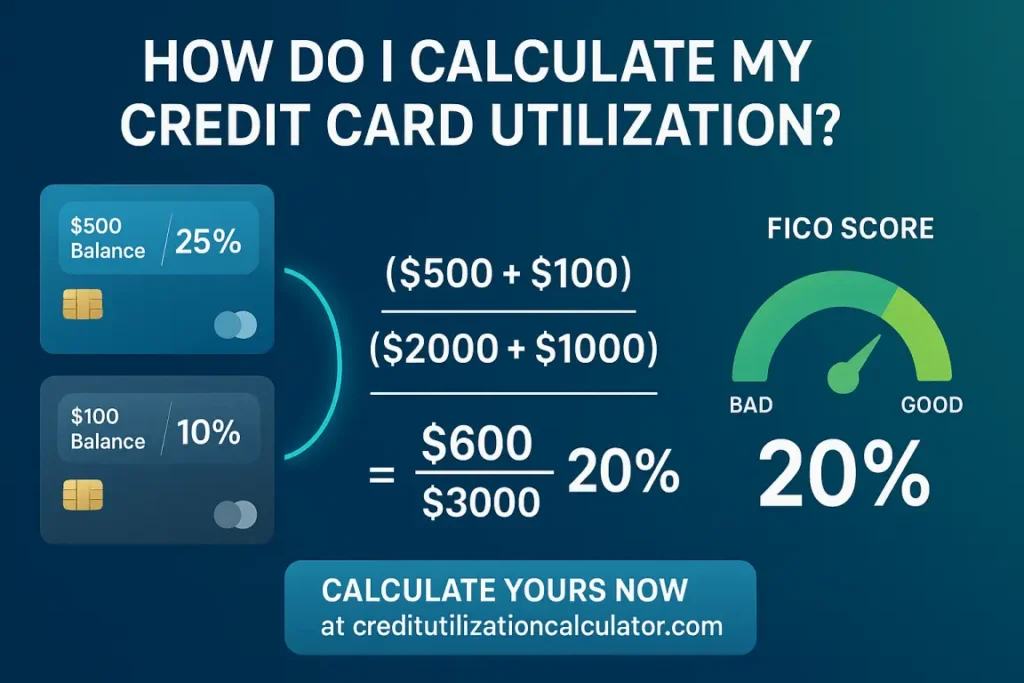

A critical nuance that most people miss is that there isn’t just one utilization number. There are two, and both are scrutinized:

- Per-Card Utilization: The utilization on each individual credit card account.

- Overall Utilization: The combined utilization across all your revolving credit accounts.

FICO’s scoring models consider both. You could have a great overall utilization but still be penalized if one card is maxed out. Mastering your score requires managing both dimensions.

The Step-by-Step Calculation Manual

Let’s break down the calculations into a simple, foolproof process. All you need are your latest credit card statements or your online banking login.

Step 1: Calculate Your Per-Card Utilization

This is your foundational step. It helps you identify specific cards that might be problematic.

The Formula:

Per-Card Utilization % = (Card’s Current Balance / Card’s Credit Limit) x 100

A Practical Example:

Imagine you have a credit card with the following details:

- Current Balance: $800

- Credit Limit: $4,000

Let’s do the math:

- Divide the balance by the limit: $800 / $4,000 = 0.20

- Multiply by 100 to get a percentage: 0.20 x 100 = 20%

This card has a 20% utilization rate, which is generally good. You should repeat this process for every card in your wallet.

Step 2: Calculate Your Overall Utilization (The Most Important Number)

This is the calculation that has the most significant impact on your FICO score. It aggregates all your credit card debt and all your available credit into one powerful number.

The Formula:

Overall Utilization % = (Total of All Balances / Total of All Credit Limits) x 100

A Practical Example:

Let’s say you have three credit cards:

- Card A: Balance = $800, Limit = $4,000

- Card B: Balance = $1,500, Limit = $3,000

- Card C: Balance = $200, Limit = $5,000

Now, let’s calculate the overall utilization:

- Total All Balances: $800 + $1,500 + $200 = $2,500

- Total All Limits: $4,000 + $3,000 + $5,000 = $12,000

- Divide total balances by total limits: $2,500 / $12,000 = 0.2083

- Multiply by 100: 0.2083 x 100 = 20.83%

Your overall credit utilization is approximately 20.83%. This gives you a much more accurate picture of your credit health than looking at any single card.

Beyond the Math: The Strategic Interpretation of Your Number

Knowing your percentage is one thing; knowing what to do with it is another. Here’s how to interpret your results and take strategic action.

The Credit Utilization Tiers

- 🚨 The Danger Zone (Above 30%): Once your overall or individual card utilization exceeds 30%, you will likely see a significant and rapid drop in your credit score. This signals to lenders that you are over-extended. Immediate action is required to pay down balances.

- ✅ The Good Zone (10% – 30%): You’re in a safe range. Your score is likely in good standing, but you are leaving points on the table. You have a solid foundation but haven’t yet optimized for a top-tier score.

- 🏆 The Excellent Zone (Below 10%): This is the golden range. Consumers who consistently maintain an overall utilization below 10% are rewarded with the highest possible scores. For those chasing perfection, the ultimate sweet spot is between 1% and 5%.

The Advanced Strategy: AZEO (All Zero Except One)

To truly maximize your score, simply having a low overall utilization isn’t always enough. This is where the advanced AZEO (All Zero Except One) strategy comes into play.

The strategy is simple but powerful:

- All Zero: Before the statement closing date for each card, pay down the balance to $0.

- Except One: On a single, strategically chosen card (often your oldest or one with a high limit), allow a small, non-zero balance to report. This balance should be between 1% and 5% of that card’s limit.

Why AZEO Works: This method sends the perfect signal to the FICO algorithm. It shows you are actively using your credit (thanks to the one small balance) but are exceptionally responsible by keeping all other accounts at a zero balance. It is the most reliable method to push your score to its absolute maximum.

The Critical Timing: When Your Utilization Matters Most

A common point of failure is misunderstanding the timing of credit reporting. You could pay your bill in full every month and still have a high utilization rate reported.

The Key Date: Your Statement Closing Date (or billing cycle end date) is the only day that matters. This is the snapshot in time that your card issuer uses to report your balance to the credit bureaus.

- Your Payment Due Date is for avoiding interest and late fees.

- Your Statement Closing Date is for determining your credit utilization.

If you spend $2,000 on a card with a $5,000 limit throughout the month and pay it off on the due date, the issuer may have already reported a 40% utilization ($2,000/$5,000) to the bureaus, causing your score to drop. Your on-time payment won’t fix that until the next cycle.

The Solution: Make strategic payments before your statement closing date to control the balance that gets reported, not just the balance you owe.

From Calculation to Action: Your Personalized Payment Plan

Let’s make this actionable. Knowing you have a 25% utilization is good. Knowing you need to pay $1,500 by next Tuesday to get it to 9% is powerful.

Example Scenario:

- Total Credit Limit: $15,000

- Total Amount Used: $5,000

- Current Utilization: 33% (In the Danger Zone!)

Your Goal: Reach an excellent 9% utilization.

- Target Balance for 9%: $15,000 (Total Limit) x 0.09 = $1,350

- Payment Required: $5,000 (Current Balance) – $1,350 (Target Balance) = $3,650

This transforms an abstract percentage into a concrete, actionable financial task.

Why Manual Calculation is No Longer Necessary

While understanding the math is empowering, manually tracking balances across multiple cards and calculating targets is time-consuming and prone to error. In our fast-paced world, you need answers instantly.

This is where a specialized tool becomes indispensable. A dedicated credit utilization calculator is designed to do the heavy lifting for you.

Your Shortcut to a Higher Score

Imagine inputting just two numbers—your total credit limit and your total used amount—and getting an instant, clear report on your credit health.

Our calculator at creditutilizationcalculator.com is built for one purpose: to give you immediate clarity and a direct path to a better score. In seconds, it provides:

- ✅ Your current utilization percentage and risk zone.

- 🎯 The exact dollar amount you need to pay to reach your ideal utilization (e.g., 9%).

- 📈 A clear understanding of how your payment will impact your score.

Don’t let confusion and manual calculations hold your credit score back. The simplest way to master your utilization is to use a tool designed for the job.