You’re the picture of financial responsibility. You use your credit card for everything to earn rewards, and you never, ever carry a balance. When the bill comes, you pay the full statement amount by the due date. You assume your credit report reflects this perfect behavior with a beautiful 0% utilization rate.

So, why is your credit score stubbornly stuck in the “good” range instead of soaring into the “excellent” zone you feel you deserve?

The answer lies in a critical timing gap that traps even the most diligent cardholders. You’re doing everything right for your wallet, but the credit scoring system is operating on a different schedule. Understanding this disconnect is the key to unlocking your score’s true potential.

The Myth: Paying in Full by the Due Date Guarantees 0% Utilization

This belief is logical and stems from a place of good habits.

- The “Paid in Full” Mindset: You’ve been told that carrying a balance is bad, so paying it off completely must be the ultimate goal. And it is—for avoiding interest!

- What “Paid in Full” Actually Means: This action is a contract between you and the bank. It ensures you pay $0 in interest and avoid late fees. The bank is happy, and your wallet is happy.

- The FICO Blind Spot: The FICO scoring algorithm doesn’t have a line item that says, “Paid in Full.” It doesn’t see your due date payment at all. It only sees the data your bank sends it.

The Reality: The Reporting Date Timing Trap

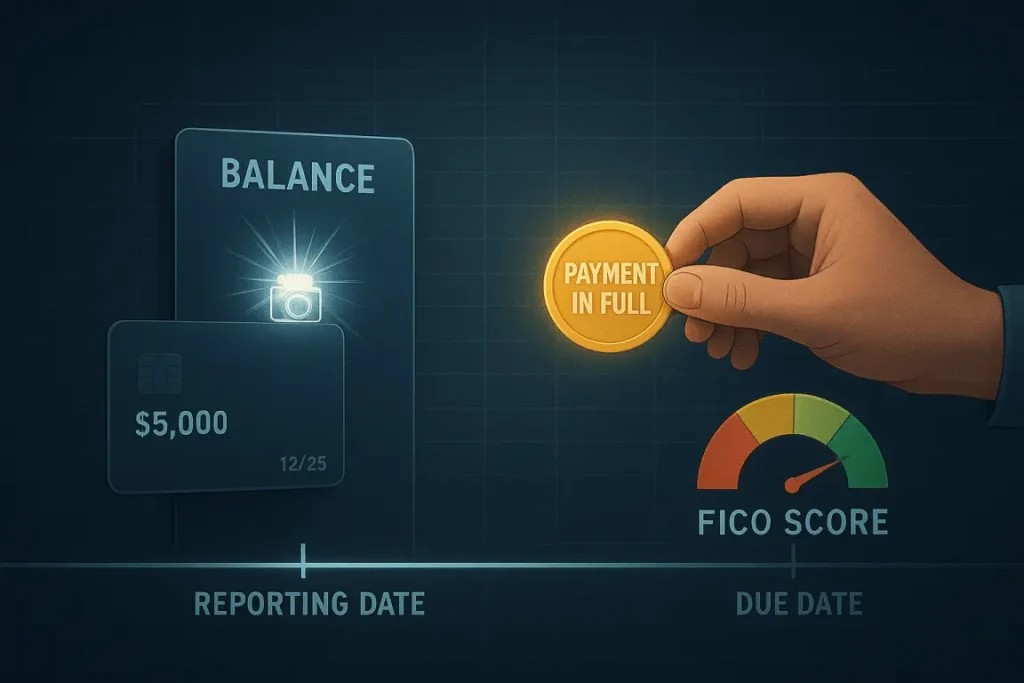

Your credit score lives and dies by a single, often-ignored date: your Statement Closing Date (also known as your Reporting Date).

Here’s the breakdown of the two key dates in your billing cycle:

- Statement Closing Date (The “Snapshot” Day): This is the last day of your billing cycle. After this day, your bank generates your statement. Crucially, they also take a snapshot of your balance on this exact day and report it to the credit bureaus. This is the only balance that matters for your credit utilization calculation.

- Payment Due Date (The “Pay Up” Day): This comes about 21-25 days after your statement closing date. It’s your deadline to pay the bank.

The Problem in Action: A Real-World Example

Let’s say your credit limit is $1,000.

- Your Spending: You spend $800 during the month of April.

- April 5th (Statement Closing Date): Your bank takes a snapshot. They see an $800 balance and report an 80% utilization rate to the credit bureaus. Your FICO score immediately drops due to the dangerously high utilization.

- April 28th (Payment Due Date): You proudly pay the full $800 statement balance. You pay $0 in interest.

- The Result: You were a responsible customer in the bank’s eyes, but your credit score was already damaged by the 80% utilization reported on the 5th. Your on-time payment was too late to stop it.

Your Actionable Solution: The Two-Payment Rule

To fix this, you don’t need to spend less; you just need to pay more strategically. Adopt the “Two-Payment Rule” to control what balance gets reported.

Payment #1: The Strategic Pre-Report Payment

- When: 3-4 business days before your Statement Closing Date.

- Goal: Log into your account and make a payment that brings your balance down to your target utilization (ideally below 10%). If your limit is $1,000 and you’ve spent $800, you would make a payment of roughly $700-$750, leaving a $50-$100 balance to be reported.

- Outcome: Your bank reports a healthy 5-10% utilization, making your score jump.

Payment #2: The Final “Paid in Full” Payment

- When: By the Payment Due Date.

- Goal: Pay off the remaining statement balance (the $50-$100 from our example) in full.

- Outcome: You achieve your original goal—paying $0 in interest—while also gaming the system to show perfect credit utilization.

This method decouples your responsible spending from the credit reporting cycle, allowing you to have your cake (rewards, convenience) and eat it too (an excellent credit score).

Conclusion: Mastering the System, Not Just the Debt

Throughout this “Myth vs. Reality” series, a common theme has emerged: achieving a stellar credit score isn’t just about being debt-averse; it’s about understanding the nuanced rules of the game.

- We learned that closing old cards to “clean up” actually harms the credit history and utilization buffers they provide.

- We discovered that a $0 balance on all cards can be less optimal than the strategic AZEO (All Zero Except One) method for maximizing your score.

- We clarified that paying off collections repairs your payment history but does nothing for your utilization ratio—they are two separate battles.

- And now, we see that paying in full is necessary to avoid interest, but it’s the timing of your payment that dictates your reported utilization.

The path to an 800+ credit score is paved with this kind of precise, strategic knowledge. It’s about moving beyond general advice and learning the specific levers to pull. By mastering your reporting dates, actively managing your balances before they’re reported, and understanding what truly influences your score, you shift from being a passive user of credit to an active architect of your financial reputation. Stop just using your cards wisely; start reporting them wisely.