You’ve been there. You find a credit utilization calculator online, punch in your numbers, and it spits out a percentage. “Your utilization is 28%,” it says. You already knew that. The real questions remain unanswered: “Is that good or bad? How much do I need to pay down to be safe? What’s my exact plan to fix this?”

This is the fundamental flaw of most calculators. They are diagnostic tools, not strategic ones. They tell you where you are, but they leave you stranded without a map to your destination.

An effective calculator doesn’t just perform math; it provides a clear, actionable strategy. It’s the difference between a thermometer that tells you you have a fever and a doctor who gives you the exact medicine and dosage to get better. This article will show you what to look for and why a purpose-built tool like ours is designed to deliver real results, not just raw data.

🔍 What Truly Makes a Credit Utilization Calculator Effective?

A powerful calculator must transcend basic arithmetic. It should be a financial co-pilot. Here are the non-negotiable features:

- Goal-Based Output: It must answer the “So what?” question. Beyond your current percentage, it needs to instantly calculate the exact dollar amount you need to pay to reach a target utilization (e.g., 10% for excellence, 30% for safety).

- Multi-Card Intelligence: Your FICO score is based on your total balances and total limits across all cards. A top-tier calculator must handle multiple cards simultaneously, giving you a true picture of your overall financial standing.

- Strategic Insight: The best tools guide you beyond the basics. They should help you visualize and plan for advanced strategies like AZEO (All Zero Except One), which is proven to maximize scores.

🏆 Why [creditutilizationcalculator.com] is the Most Effective Tool

Our tool was built from the ground up with one goal: to turn complex credit scoring principles into a simple, actionable plan for anyone.

A. Simple, Powerful, and Instant

We stripped away the clutter. The interface is clean, fast, and requires no financial expertise. You input your numbers, and within seconds, you receive a crystal-clear snapshot of your credit health and the precise steps to improve it. We handle the complex math so you can focus on what matters—taking action.

B. Key Feature 1: AZEO-Ready Strategy

The Advantage: While other calculators give you a monolithic number, ours acknowledges a critical fact of credit scoring: how your balances are distributed matters. Our tool allows you to model the impact of the AZEO strategy—showing you how keeping all cards at a $0 balance except for one with a small, strategic balance (1-9%) can optimize your score.

What Other Calculators Miss: They typically sum everything into a single percentage, completely ignoring this powerful FICO loophole. They give you the “what,” but they fail to guide you on the “how.”

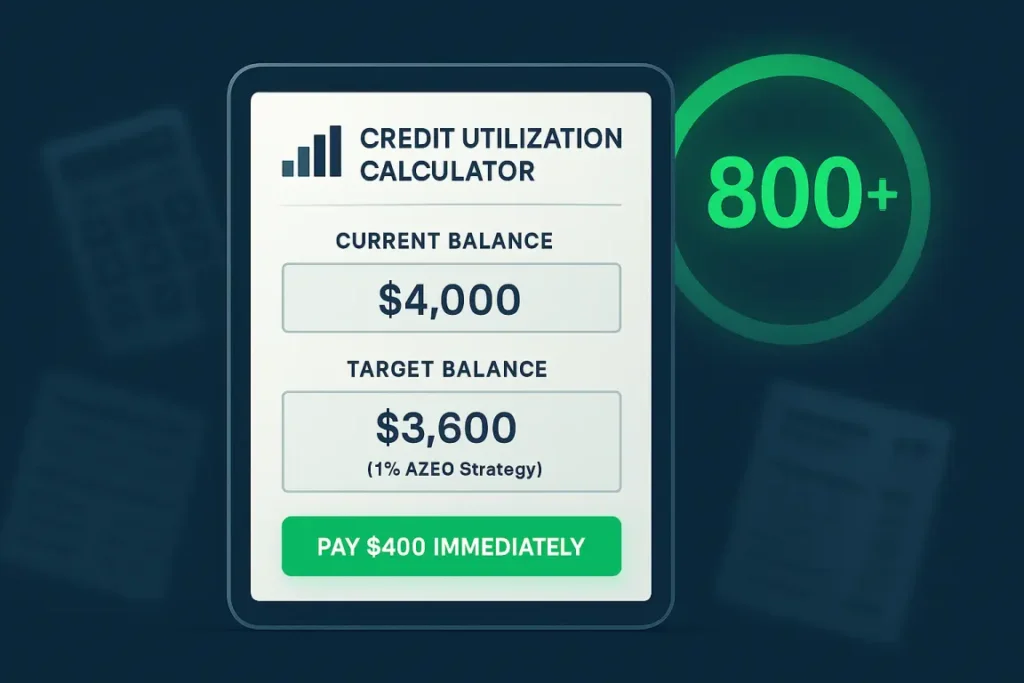

C. Key Feature 2: Your Personal Payment Plan

The Advantage: This is our core differentiator. You enter your total credit limits and total balances. Then, you simply select your goal—for example, “Reach 9% Utilization.” The calculator doesn’t just show you the new percentage; it instantly tells you: “You need to pay down $X to reach your goal.”

Real-World Solution: This eliminates guesswork and anxiety. You get a specific, actionable task. Instead of wondering, “Should I pay $200 or $500?”, you know the exact amount required to achieve your desired score improvement.

What Other Common Calculators Miss

- The Single-Card Fallacy: Many basic calculators only allow for one card, providing a misleading and incomplete view that is irrelevant to your actual FICO score calculation.

- No Strategic Context: They operate in a vacuum, failing to educate users on critical concepts like the statement closing date, which is the only date that matters for utilization. Our tool is part of a larger ecosystem of educational content that teaches you the “why” behind the numbers.

- Clunky User Experience: They are often slow, filled with ads, or require unnecessary information, frustrating users and driving them away before they get an answer.

🛠️ How to Use [creditutilizationcalculator.com] in 3 Simple Steps

- Enter Your Limits & Balances: Input the total credit limit and total current balance across all your credit cards.

- Choose Your Score Goal: Select whether you’re targeting an “Excellent” (e.g., 9%) or “Good” (e.g., 29%) utilization rate.

- Get Your Action Plan: The calculator immediately reveals your current utilization and, most importantly, the exact payment amount you need to make to hit your goal.

Conclusion: Stop Calculating, Start Strategizing

The most effective credit utilization calculator isn’t the one with the most complex formulas; it’s the one that empowers you to make the best financial decision in the shortest amount of time. It’s a tool that prioritizes strategy over simple arithmetic and provides clarity over mere data.

Stop guessing and start executing a precise plan. Discover the exact steps you need to take to lower your utilization and raise your score today.